Investing in the stock market can feel like stepping into a labyrinth filled with opportunities and risks, but there's one name that keeps shining brightly—TSM stock. Whether you're a seasoned investor or just dipping your toes into the world of finance, understanding TSM stock is crucial if you want to secure your financial future. This isn't just any stock; it's a game-changer in the semiconductor industry, and we're about to dive deep into why it matters.

Imagine a world where technology runs the show. From smartphones to electric cars, everything relies on chips, and TSM stock is at the heart of it all. Taiwan Semiconductor Manufacturing Company, or TSMC, is the powerhouse behind the scenes, producing the chips that power our daily lives. If you're thinking about investing, this is the stock you need to know about.

So, buckle up because we're going to explore everything you need to know about TSM stock. From its background to its potential, we'll break it all down so you can make informed decisions. Let's get started!

Read also:Unveiling The Thrill Alaska Snowmobile Salvage Anchorage

What is TSM Stock?

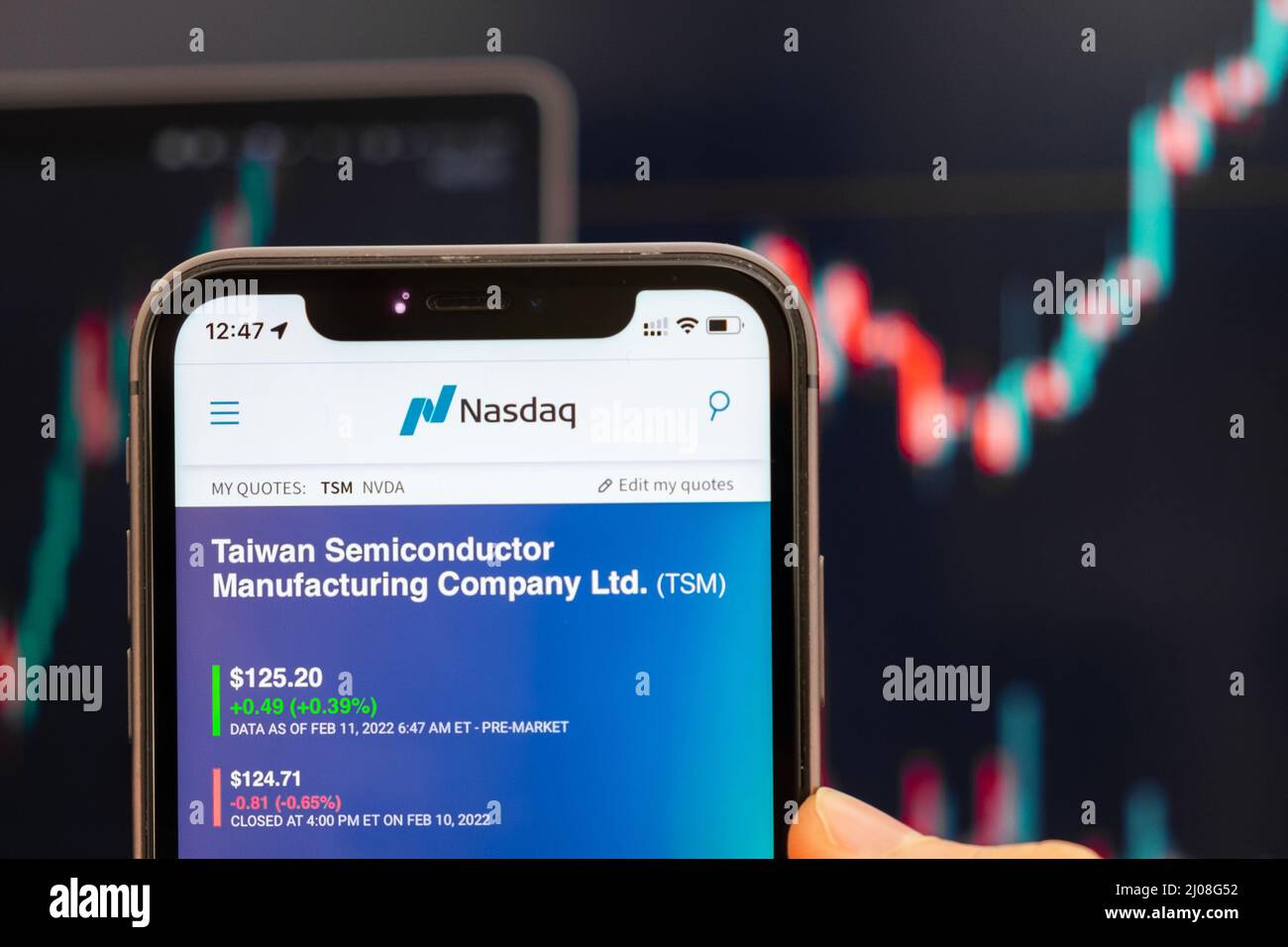

TSM stock refers to the shares of Taiwan Semiconductor Manufacturing Company, a global leader in semiconductor foundry services. Founded in 1987, TSMC has grown to become the largest independent semiconductor foundry in the world. Their mission? To provide cutting-edge technology and manufacturing solutions for their customers. If you're looking for a stock that's synonymous with innovation, TSM stock is it.

TSMC operates on a simple yet powerful business model: they focus solely on manufacturing semiconductors for other companies, allowing them to concentrate on what they do best—making chips. This specialization has set them apart in the industry, making TSM stock an attractive option for investors who believe in the power of technology.

Why Should You Care About TSM Stock?

In a world driven by data and technology, TSM stock is more than just an investment opportunity—it's a gateway to the future. Here are some reasons why you should pay attention:

- Innovation Leader: TSMC consistently pushes the boundaries of semiconductor technology, producing chips that are faster, more efficient, and more powerful.

- Global Impact: The company supplies chips to some of the biggest tech giants, including Apple, NVIDIA, and AMD.

- Financial Stability: TSMC has a strong financial position, with consistent revenue growth and a solid dividend history.

With the global demand for semiconductors on the rise, TSM stock is poised to benefit from this trend, making it a smart addition to any investment portfolio.

Understanding the Semiconductor Industry

Before we dive deeper into TSM stock, let's take a moment to understand the semiconductor industry. Semiconductors are the building blocks of modern technology, and their demand is skyrocketing. From smartphones to artificial intelligence, semiconductors are everywhere. TSMC, with its advanced manufacturing capabilities, is at the forefront of this revolution.

The industry is characterized by rapid innovation and intense competition, but TSMC stands out due to its focus on research and development. They invest heavily in R&D, ensuring they stay ahead of the curve. This commitment to innovation is one of the reasons why TSM stock is so appealing to investors.

Read also:Celebrity In Dti Where Fame Meets Entrepreneurship

Key Players in the Semiconductor Industry

While TSMC dominates the foundry segment, they aren't alone in the semiconductor space. Companies like Intel, Samsung, and GlobalFoundries are also significant players. However, TSMC's specialization in foundry services gives them a unique advantage. Unlike these competitors, TSMC doesn't design chips, allowing them to remain neutral and cater to a wide range of clients.

This neutrality is crucial because it means TSMC can work with companies like Apple and Qualcomm without any conflicts of interest. It's this business model that makes TSM stock so attractive to investors looking for stability and growth.

Financial Performance of TSM Stock

When it comes to financial performance, TSM stock doesn't disappoint. The company has consistently delivered impressive results, with revenue and profit margins growing year over year. In 2022 alone, TSMC reported a revenue of over $70 billion, a testament to their dominance in the industry.

Investors also love TSM stock for its dividend policy. The company has a history of paying regular dividends, providing a steady stream of income for shareholders. This combination of growth and income makes TSM stock an attractive option for both growth and income investors.

Revenue Growth and Market Share

TSMC's revenue growth is driven by their expanding market share. They currently hold over 50% of the global foundry market, a position they've achieved through continuous investment in technology and capacity expansion. This market dominance is reflected in their stock performance, with TSM stock consistently outperforming its peers.

As the demand for semiconductors continues to rise, TSMC is well-positioned to capitalize on this trend, further solidifying their position in the industry and making TSM stock a smart investment choice.

TSM Stock: A Look at the Risks

While TSM stock offers plenty of opportunities, it's not without its risks. The semiconductor industry is highly cyclical, meaning it can be subject to boom-and-bust cycles. Economic downturns or changes in technology trends can impact demand for semiconductors, affecting TSM stock's performance.

Additionally, geopolitical tensions, particularly between the U.S. and China, pose a risk to TSMC's operations. As a Taiwanese company with significant exposure to global markets, any disruption in international relations could impact their business. Investors need to be aware of these risks when considering TSM stock as part of their portfolio.

Managing Risk in Your Portfolio

To mitigate these risks, investors can diversify their portfolios by including other sectors and asset classes. While TSM stock is a strong performer, it's important to balance it with other investments to ensure overall portfolio stability. Regularly reviewing and adjusting your portfolio can help you manage risk effectively.

Another strategy is to invest in TSM stock gradually, rather than all at once. This approach, known as dollar-cost averaging, can help smooth out the impact of market volatility on your investment.

Future Prospects of TSM Stock

The future looks bright for TSM stock. With the global demand for semiconductors expected to grow, TSMC is well-positioned to benefit from this trend. They are investing heavily in expanding their manufacturing capacity and developing next-generation technologies, ensuring they remain at the forefront of the industry.

Moreover, the shift towards renewable energy and electric vehicles is creating new opportunities for TSMC. As these industries grow, so will the demand for semiconductors, further boosting TSM stock's potential.

TSMC's Role in Shaping the Future

TSMC isn't just a company; it's a driving force behind the technological advancements shaping our world. From 5G networks to artificial intelligence, TSMC's chips are powering the innovations that will define the future. This leadership role makes TSM stock a compelling investment for those looking to capitalize on the tech revolution.

As TSMC continues to innovate and expand, TSM stock is likely to remain a key player in the global investment landscape.

How to Invest in TSM Stock

Ready to invest in TSM stock? Here's how you can get started:

- Open a Brokerage Account: Choose a reputable brokerage firm that offers access to international markets.

- Research and Analyze: Before buying, make sure you understand the company's financials, market position, and growth prospects.

- Place Your Order: Once you're ready, place a buy order for TSM stock through your brokerage account.

Remember, investing is a long-term game. While TSM stock has shown strong performance, it's important to have a well-thought-out strategy and stay informed about market trends.

Conclusion: Is TSM Stock Right for You?

TSM stock offers a unique opportunity for investors looking to tap into the growth of the semiconductor industry. With its leadership in innovation, strong financial performance, and promising future prospects, TSM stock is a solid choice for those who believe in the power of technology.

However, like any investment, it's important to weigh the risks and rewards. Diversify your portfolio, stay informed, and make decisions based on thorough research. If you're ready to take the plunge, TSM stock could be the key to unlocking your financial potential.

So, what are you waiting for? Dive into the world of TSM stock and start building your future today. Don't forget to share your thoughts in the comments and check out other articles for more investment insights!

Table of Contents