Hey there, folks! Let me tell you something interesting about FOMC. This is not just another acronym floating around the financial world; it's actually a game-changer when it comes to shaping the economic landscape of the United States. Think of it as the brains behind the operation, making decisions that ripple through markets worldwide. So, buckle up because we’re diving deep into what FOMC really means and why you should care about it. Whether you're an investor, economist, or just someone curious about how the economy works, this article’s got you covered.

You might be wondering, what exactly does FOMC do? Well, it stands for the Federal Open Market Committee, and its primary job is to steer monetary policy in the US. This committee has the power to influence interest rates, control inflation, and manage unemployment. Sounds heavy, right? But don’t worry, we’ll break it down into bite-sized chunks so it’s easier to digest. And trust me, by the end of this article, you’ll have a solid understanding of how this committee impacts your wallet.

Let’s face it, the world of finance can get pretty overwhelming with all the jargon and numbers flying around. But here’s the thing – understanding FOMC is crucial if you want to make informed decisions about your money. From setting interest rates to buying and selling government securities, this committee plays a key role in maintaining economic stability. So, are you ready to uncover the secrets behind FOMC and see how it affects your life? Let’s dive in!

Read also:Elaine Dratch The Woman Behind The Laughter

What is FOMC and Why Should You Care?

Alright, let’s get down to business. FOMC, or the Federal Open Market Committee, is essentially the decision-making body within the Federal Reserve System. Its main responsibility is to conduct open market operations, which are basically the buying and selling of government securities to influence the money supply and interest rates. But why should you care? Well, because the decisions made by FOMC directly affect things like mortgage rates, credit card interest, and even the overall health of the economy.

For instance, when FOMC decides to lower interest rates, borrowing becomes cheaper, which can stimulate spending and investment. On the flip side, raising interest rates can help control inflation by making borrowing more expensive. These moves may seem small, but they have a huge impact on both the national and global economy. So, whether you're planning to buy a house, start a business, or simply save for retirement, keeping an eye on FOMC’s actions is a smart move.

How FOMC Works: Breaking It Down

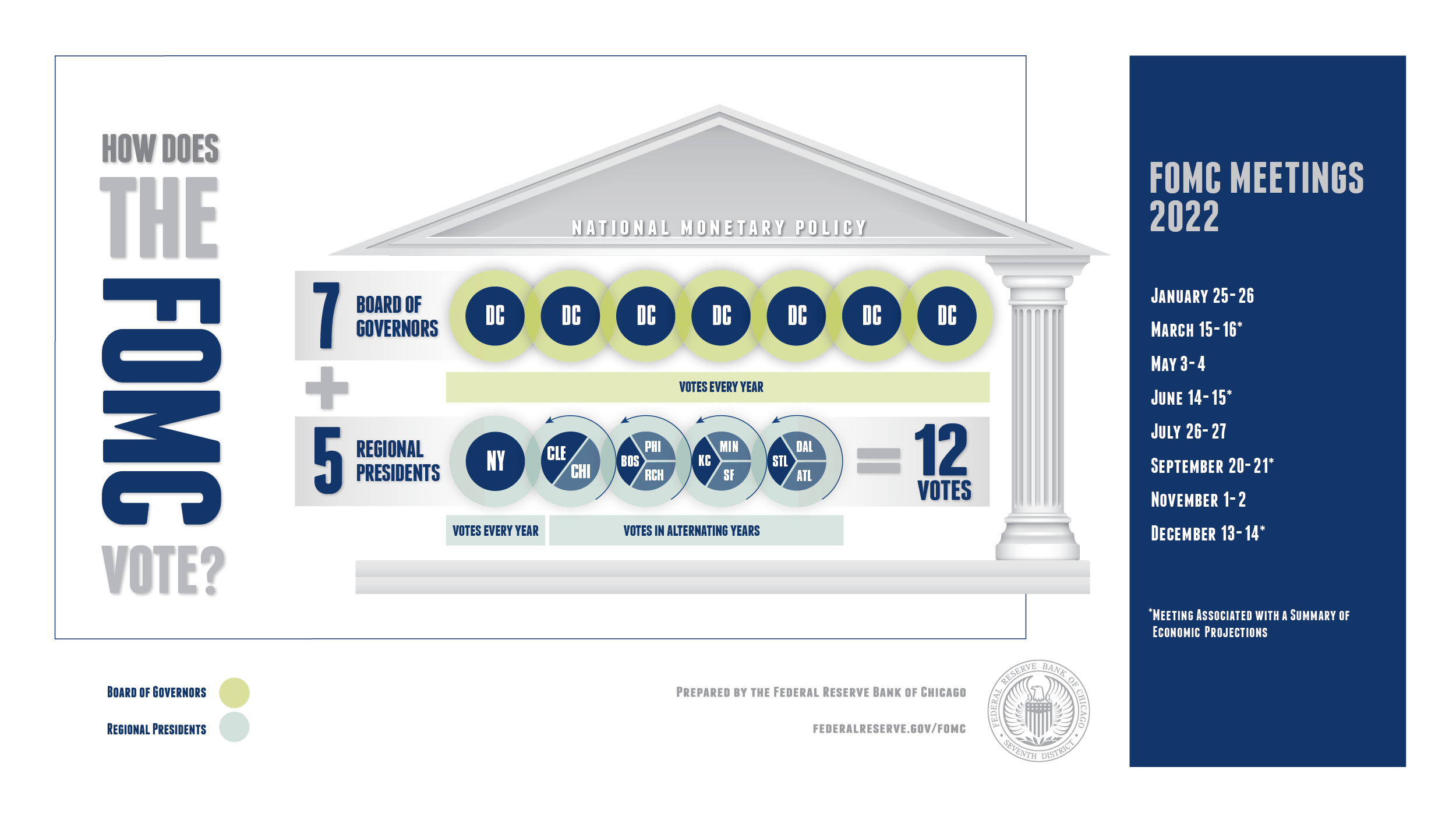

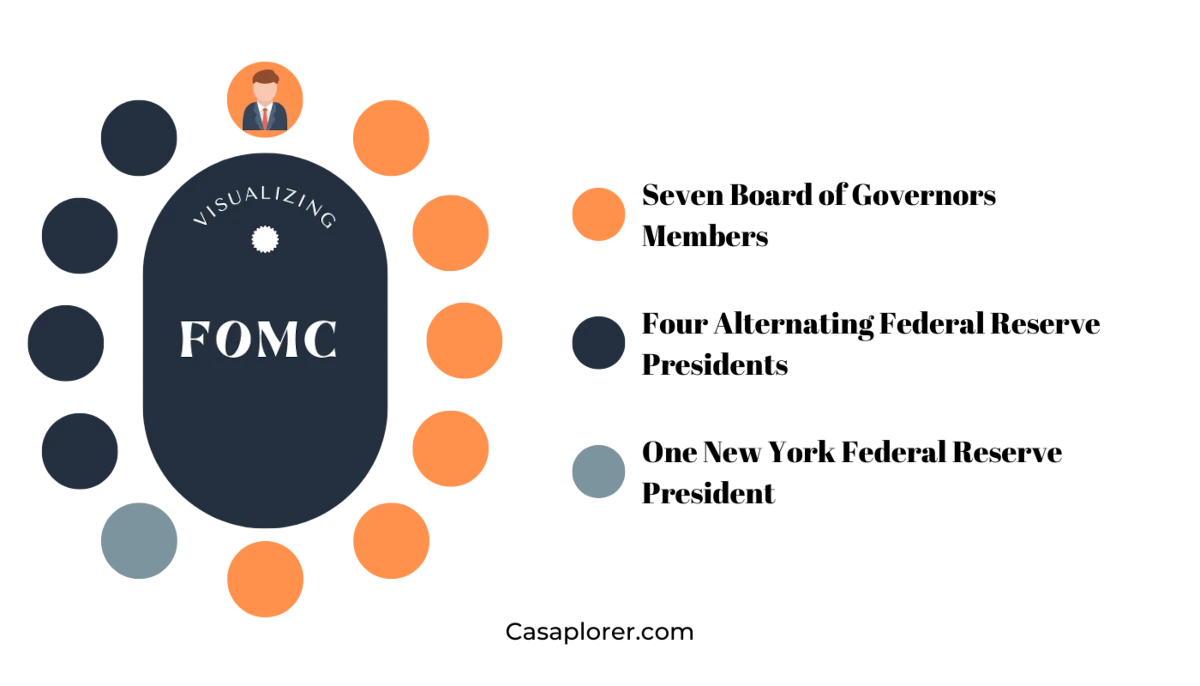

Now that we’ve established what FOMC is, let’s talk about how it operates. The committee consists of 12 members, including the seven members of the Board of Governors of the Federal Reserve System and five of the 12 Federal Reserve Bank presidents. These guys meet eight times a year to discuss and decide on monetary policy. During these meetings, they analyze economic data, discuss current trends, and make decisions that affect the entire financial system.

One of the key tools FOMC uses is the federal funds rate, which is the interest rate at which banks lend reserve balances to other banks on an overnight basis. By adjusting this rate, FOMC can influence the cost of borrowing and lending across the economy. Additionally, they engage in quantitative easing or tightening, which involves buying or selling government bonds to inject or withdraw money from the economy. It’s like a delicate balancing act, and getting it right is crucial for maintaining economic stability.

Meet the Players: Who’s on the FOMC?

So, who exactly makes up this powerful committee? As mentioned earlier, FOMC consists of 12 members. The seven members of the Board of Governors are appointed by the President and confirmed by the Senate. These positions are meant to provide a broad perspective on the economy. Then there are the five Federal Reserve Bank presidents, who rotate on a yearly basis to ensure diverse representation from different regions of the country. Each member brings their own expertise and insights to the table, making the decision-making process more robust and well-rounded.

Key Responsibilities of FOMC

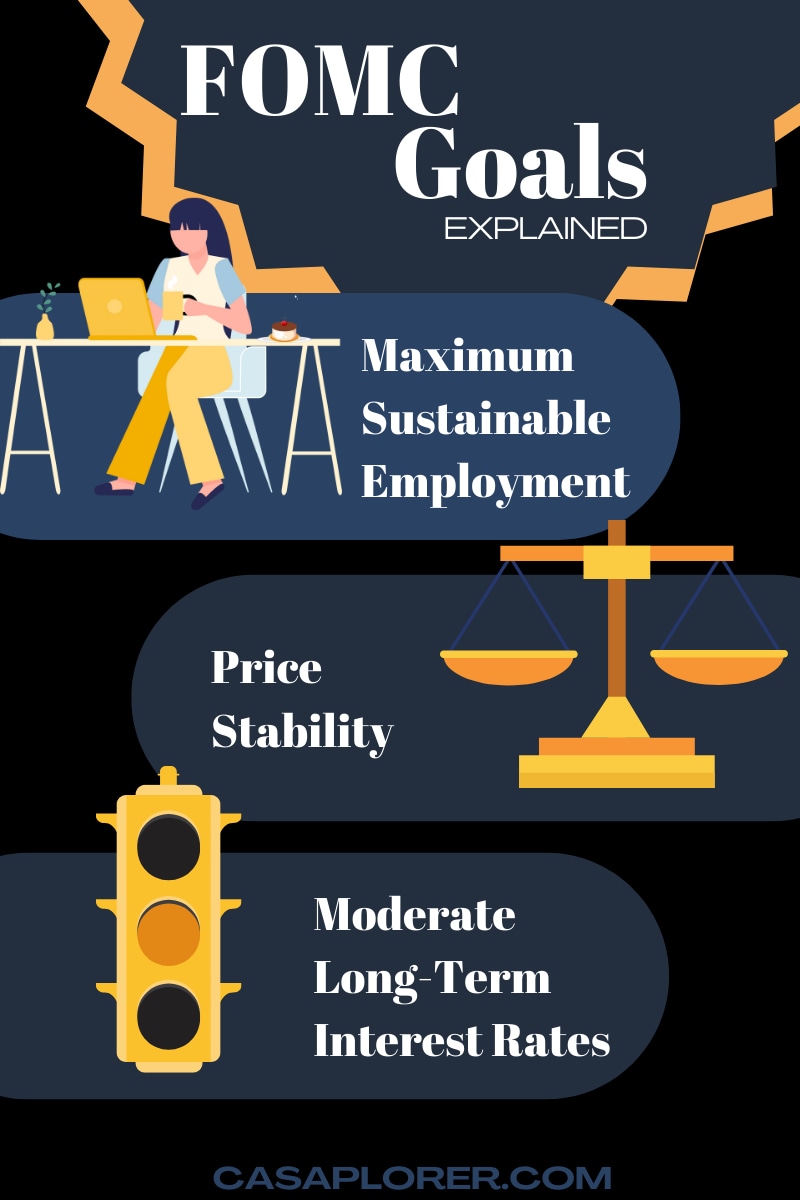

Let’s talk about the main responsibilities of FOMC. First and foremost, they’re tasked with promoting maximum employment, stable prices, and moderate long-term interest rates. These goals are often referred to as the “dual mandate” of the Federal Reserve. To achieve these objectives, FOMC uses a variety of tools, including adjusting the federal funds rate, conducting open market operations, and implementing forward guidance.

Read also:Palace Theater Stafford Ct Your Ultimate Guide To The Iconic Venue

But here’s the kicker – balancing these goals isn’t always easy. For example, lowering interest rates to boost employment might lead to inflation, while raising rates to control inflation could slow down job growth. It’s a constant trade-off, and FOMC has to carefully weigh the pros and cons of each decision. That’s why their meetings are so crucial – they allow members to discuss and debate the best course of action based on the latest economic data.

Impact of FOMC on the Economy

Now, let’s explore how FOMC’s decisions impact the economy. One of the most significant ways is through interest rates. When FOMC lowers rates, it becomes cheaper for businesses and consumers to borrow money, which can stimulate spending and investment. This, in turn, can lead to job creation and economic growth. Conversely, raising rates can help curb inflation by making borrowing more expensive, which reduces spending and slows down the economy.

Another way FOMC influences the economy is through quantitative easing or tightening. By purchasing government securities, they inject money into the system, increasing liquidity and encouraging lending. On the other hand, selling these securities withdraws money from the system, reducing liquidity and tightening credit conditions. These actions can have a ripple effect throughout the financial markets, affecting everything from stock prices to exchange rates.

Real-World Examples: FOMC in Action

To give you a better idea of how FOMC works, let’s look at some real-world examples. During the 2008 financial crisis, FOMC implemented aggressive monetary policies, including cutting interest rates to near zero and launching several rounds of quantitative easing. These measures helped stabilize the financial system and prevent a deeper recession. More recently, in response to the COVID-19 pandemic, FOMC once again lowered rates and engaged in large-scale asset purchases to support the economy.

FOMC Meetings: What Happens Behind Closed Doors?

Ever wondered what goes on during those FOMC meetings? Well, it’s a pretty intense process. The committee spends hours analyzing economic data, discussing current trends, and debating the best course of action. They look at everything from employment figures and inflation rates to consumer spending and housing markets. Once they’ve gathered all the information, they vote on monetary policy decisions, which are then announced to the public.

But here’s the thing – these meetings aren’t just about making decisions. They also serve as a platform for members to share their perspectives and insights. This open dialogue helps ensure that all viewpoints are considered before any final decisions are made. And while the meetings themselves are private, FOMC does release detailed minutes a few weeks later, giving the public a glimpse into their deliberations.

Challenges Faced by FOMC

Of course, FOMC isn’t without its challenges. One of the biggest hurdles they face is predicting the future. Economic conditions can change rapidly, and making decisions based on outdated or incomplete data can be risky. Additionally, there’s always the possibility of unforeseen events, like natural disasters or geopolitical tensions, that can disrupt the economy and force FOMC to adjust their plans.

Another challenge is balancing competing interests. For example, while lowering interest rates might help boost employment, it could also lead to inflation. Similarly, raising rates to control inflation might slow down job growth. Finding the right balance is crucial, but it’s not always easy. That’s why FOMC relies heavily on data and analysis to guide their decisions.

Dealing with Economic Uncertainty

In times of uncertainty, FOMC often turns to unconventional tools to manage the economy. This might include forward guidance, where they communicate their intentions for future policy moves to influence market expectations. They might also engage in large-scale asset purchases, as we saw during the financial crisis and the pandemic. These actions can help stabilize the financial system and provide a safety net for the economy during turbulent times.

FOMC and Global Markets

While FOMC’s primary focus is on the US economy, its decisions also have a significant impact on global markets. For example, changes in US interest rates can affect currency exchange rates, stock prices, and capital flows around the world. This is because the US dollar is the world’s reserve currency, and many countries peg their currencies to it. So, when FOMC raises or lowers rates, it can cause ripples throughout the global financial system.

Additionally, FOMC’s actions can influence investor sentiment and market behavior. If they signal a tightening of monetary policy, for instance, it might lead to a sell-off in emerging markets as investors move their money to safer assets. Conversely, a loosening of policy might encourage risk-taking and boost global markets. It’s a complex web, and FOMC has to consider these global implications when making decisions.

Looking Ahead: The Future of FOMC

As we look to the future, FOMC will continue to play a vital role in shaping the economic landscape. With ongoing challenges like climate change, technological advancements, and demographic shifts, the committee will need to adapt and evolve to meet the needs of a changing world. This might involve exploring new tools and approaches to monetary policy, as well as collaborating with other central banks to address global issues.

But one thing’s for sure – FOMC will remain a key player in the financial world, influencing everything from interest rates to inflation. So, whether you’re an investor, economist, or just someone interested in how the economy works, keeping an eye on FOMC’s actions is a smart move. And who knows? You might just learn something that could help you make better financial decisions.

Key Takeaways: What We’ve Learned About FOMC

Let’s recap some of the key points we’ve covered about FOMC. First, it’s the decision-making body within the Federal Reserve System responsible for conducting open market operations and influencing monetary policy. Second, its main responsibilities include promoting maximum employment, stable prices, and moderate long-term interest rates. Third, FOMC’s decisions have a significant impact on both the US and global economy, affecting everything from interest rates to stock prices.

Final Thoughts: Why FOMC Matters to You

So, there you have it – a deep dive into the world of FOMC and why it matters to you. Whether you’re planning to buy a house, start a business, or simply save for retirement, understanding how this committee works and the decisions they make can help you make more informed financial decisions. And while the world of finance can sometimes seem overwhelming, taking the time to learn about FOMC is a step in the right direction.

Now, here’s where you come in. If you found this article helpful, why not share it with your friends and family? Or better yet, leave a comment below and let us know what you think. And if you want to dive even deeper into the world of finance, be sure to check out some of our other articles. Who knows? You might just discover something that could change your financial future.

Table of Contents

- Introduction

- What is FOMC and Why Should You Care?

- How FOMC Works: Breaking It Down

- Meet the Players: Who’s on the FOMC?

- Key Responsibilities of FOMC

- Impact of FOMC on the Economy

- Real-World Examples: FOMC in Action

- FOMC Meetings: What Happens Behind Closed Doors?

- Challenges Faced by FOMC

- FOMC and Global Markets

- Looking Ahead: The Future of FOMC