Hey there, finance enthusiasts! Let's dive straight into the world of finance where one name stands out like a shining star—Goldman Sachs. If you've ever wondered about the financial behemoths that shape global markets, this article is for you. Goldman Sachs isn’t just another Wall Street firm; it’s a powerhouse that influences economies worldwide. So, buckle up as we unravel the story behind this financial giant!

Now, why should you care about Goldman Sachs? Well, if you're into investing, economics, or simply curious about the forces that move global markets, understanding Goldman Sachs is crucial. This firm has been at the forefront of financial innovation, setting trends, and sometimes, controversies. We'll explore its history, impact, and how it continues to shape the financial landscape today.

In this article, we’ll break down the complexities of Goldman Sachs in a way that’s easy to digest. Whether you’re a seasoned investor or just starting to dip your toes into the world of finance, this guide will equip you with the knowledge you need. So, let’s get started and uncover what makes Goldman Sachs such a dominant force in the financial world!

Read also:Dirty Dr Pepper Sonic The Ultimate Guide To A Sweet And Salty Sensation

Table of Contents

- The History of Goldman Sachs

- Biography of Goldman Sachs

- Goldman Sachs' Global Impact

- Organizational Structure

- Financial Innovation

- Controversies Surrounding Goldman Sachs

- The Future of Goldman Sachs

- Key Data and Statistics

- Competitors and Market Position

- Conclusion

The History of Goldman Sachs

Goldman Sachs wasn’t always the financial titan it is today. Back in 1869, Marcus Goldman started a small commercial paper business in New York City. Fast forward a few decades, and Goldman Sachs Group, Inc. became a household name in the world of finance. This journey from a humble beginning to becoming a global leader is nothing short of inspiring.

Throughout its history, Goldman Sachs has undergone numerous transformations, adapting to changing market conditions and economic landscapes. It’s this adaptability that has allowed the firm to thrive even in the face of adversity. From surviving the Great Depression to navigating the 2008 financial crisis, Goldman Sachs has consistently demonstrated resilience and innovation.

Key Milestones in Goldman Sachs' History

- 1869: Marcus Goldman establishes a commercial paper business.

- 1906: Goldman Sachs is officially formed with the partnership of Marcus Goldman's son-in-law, Samuel Sachs.

- 1928: Goldman Sachs launches its first mutual fund, marking a shift towards broader financial services.

- 1999: The firm goes public, raising over $4 billion in its IPO.

- 2008: Survives the financial crisis, becoming a bank holding company to access emergency funds.

Biography of Goldman Sachs

Let’s take a closer look at the life and times of Goldman Sachs through a more detailed biography. Below is a table summarizing key aspects of the firm:

| Category | Details |

|---|---|

| Founded | 1869 |

| Founder | Marcus Goldman |

| Headquarters | New York City, USA |

| Revenue | $59.3 billion (2022) |

| Employees | Over 48,000 |

Goldman Sachs' Global Impact

Goldman Sachs doesn’t just operate in one corner of the world; it has a global presence that influences economies worldwide. Its impact is felt across continents, from advising governments on fiscal policies to helping corporations raise capital. This reach gives Goldman Sachs unparalleled power in shaping global financial trends.

Moreover, the firm’s expertise extends beyond traditional banking services. It plays a significant role in areas like mergers and acquisitions, asset management, and investment research. This diverse portfolio allows Goldman Sachs to stay ahead of the curve and offer comprehensive financial solutions to its clients.

Regional Influence

While Goldman Sachs is headquartered in the U.S., its influence spans the globe. In Asia, it has been instrumental in facilitating investments and advising on major business deals. In Europe, it works closely with governments and corporations to drive economic growth. This global footprint is what sets Goldman Sachs apart from its competitors.

Read also:Decoding Fbhttps Www Facebook Com Your Ultimate Guide To Facebook Urls

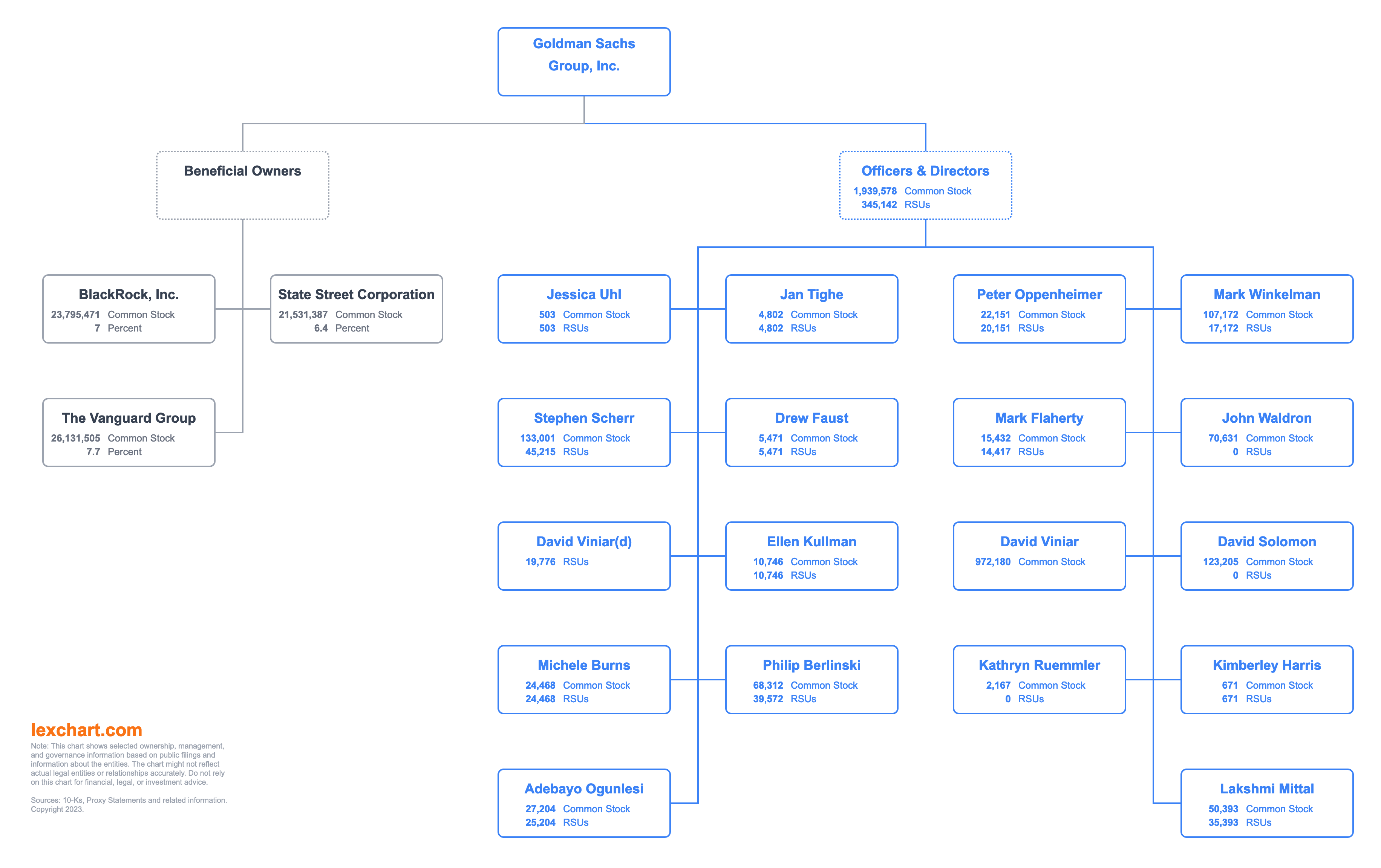

Organizational Structure

Understanding the organizational structure of Goldman Sachs is key to appreciating its operational efficiency. The firm is divided into several business units, each focusing on specific areas of finance. This division allows for specialization and expertise in various financial services.

Some of the major divisions include Investment Banking, Global Markets, Asset Management, and Consumer and Wealth Management. Each division operates semi-independently, yet collaborates when needed to deliver comprehensive financial solutions.

Leadership Team

At the helm of Goldman Sachs is a leadership team composed of experienced professionals who guide the firm’s strategic direction. David Solomon, the current CEO, brings a wealth of knowledge and experience to the table, ensuring that Goldman Sachs remains at the forefront of financial innovation.

Financial Innovation

Innovation is at the core of Goldman Sachs’ success. The firm has always been at the cutting edge of financial technology, leveraging advancements to enhance its services. From developing proprietary trading algorithms to embracing blockchain technology, Goldman Sachs is constantly pushing the boundaries of what’s possible in finance.

Moreover, the firm invests heavily in research and development, ensuring that it stays ahead of emerging trends. This commitment to innovation not only benefits its clients but also solidifies Goldman Sachs’ position as a leader in the financial industry.

Emerging Technologies

Goldman Sachs is actively exploring emerging technologies like artificial intelligence and machine learning to enhance its operations. These technologies are being used to improve risk assessment, optimize trading strategies, and provide better insights to clients. The firm’s willingness to embrace new technologies is a testament to its forward-thinking approach.

Controversies Surrounding Goldman Sachs

No story about Goldman Sachs would be complete without mentioning the controversies that have surrounded the firm. From accusations of unethical practices to involvement in financial scandals, Goldman Sachs has faced its fair share of challenges. However, the firm has consistently worked to address these issues and restore public trust.

One of the most notable controversies involved the firm’s role in the 2008 financial crisis. While it weathered the storm, Goldman Sachs faced criticism for its involvement in complex financial products that contributed to the crisis. Since then, the firm has implemented stricter controls and transparency measures to prevent similar issues in the future.

Steps to Regain Trust

To regain public trust, Goldman Sachs has taken several steps, including increasing transparency in its operations and enhancing its corporate governance practices. The firm has also been proactive in addressing social and environmental issues, demonstrating its commitment to responsible business practices.

The Future of Goldman Sachs

Looking ahead, the future of Goldman Sachs appears bright. The firm continues to innovate and expand its services, positioning itself for long-term success. With a focus on sustainable finance and digital transformation, Goldman Sachs is well-prepared to meet the challenges of the future.

Moreover, the firm’s global reach and diverse portfolio provide a solid foundation for growth. As the financial landscape continues to evolve, Goldman Sachs is poised to remain a dominant force in the industry, driving innovation and setting new standards for excellence.

Trends to Watch

Some of the key trends to watch in Goldman Sachs’ future include the expansion of its digital banking services, increased focus on ESG (Environmental, Social, and Governance) investing, and further integration of AI in its operations. These trends reflect the firm’s commitment to staying ahead of the curve and meeting the changing needs of its clients.

Key Data and Statistics

Here are some key data points that highlight Goldman Sachs’ financial prowess:

- Revenue in 2022: $59.3 billion

- Net Income in 2022: $11.7 billion

- Market Capitalization: Over $100 billion

- Global Presence: Operations in over 50 countries

These numbers underscore the firm’s financial strength and global influence, making it a formidable player in the financial world.

Competitors and Market Position

In the highly competitive world of finance, Goldman Sachs faces stiff competition from other major players. Firms like JPMorgan Chase, Morgan Stanley, and Citigroup are just a few of the names vying for market share in the financial services industry. However, Goldman Sachs maintains a strong market position due to its expertise, innovation, and global reach.

Despite the competition, Goldman Sachs continues to differentiate itself through its focus on client-centric solutions and cutting-edge technology. This focus ensures that the firm remains a preferred choice for clients seeking comprehensive financial services.

Competitive Edge

Goldman Sachs’ competitive edge lies in its ability to adapt to changing market conditions and leverage technology to enhance its services. By staying ahead of trends and continuously innovating, the firm maintains its position as a leader in the financial industry.

Conclusion

In conclusion, Goldman Sachs is more than just a financial firm; it’s a global powerhouse that shapes the financial landscape. From its humble beginnings to its current status as a financial titan, the firm has demonstrated resilience, innovation, and a commitment to excellence.

We hope this article has provided you with valuable insights into the world of Goldman Sachs. If you found this information helpful, we encourage you to share it with others and explore more content on our site. And hey, if you’ve got thoughts or questions, drop them in the comments below—we’d love to hear from you!