Hey there, stock market enthusiasts! If you're here, chances are you're curious about one of the biggest tech giants out there—Google. Specifically, you wanna dive deep into Google stock. Well, you're in the right place, my friend! Google stock isn't just a financial asset; it's a gateway into understanding one of the most innovative companies in the world. Let's break it down, piece by piece, and uncover why this stock is worth your attention.

Now, let's get real for a sec. Google stock has been on a rollercoaster ride over the years. It's seen astronomical highs and, yeah, some not-so-great lows too. But that's what makes it so intriguing, right? Whether you're a seasoned investor or just starting out, understanding Google stock can give you a competitive edge in the market. Stick around, because we're about to take you on a journey through the world of Google stock.

Before we dive in, let's talk about why Google stock matters. It's not just about buying shares; it's about being part of a company that's shaping the future. From its groundbreaking search engine to its cutting-edge AI technology, Google is a powerhouse. And when you invest in Google stock, you're essentially betting on the company's ability to continue innovating and dominating the tech industry. So, are you ready to learn more? Let's go!

Read also:American Legion Morgantown Wv Your Goto Place For Community Camaraderie And Service

What Exactly is Google Stock?

Alright, let's start with the basics. Google stock refers to the shares of Alphabet Inc., the parent company of Google. When you buy Google stock, you're essentially buying a tiny piece of this massive corporation. But here's the kicker—Google stock isn't just one type of stock. There are actually three classes of shares: Class A, Class B, and Class C. Each class has its own set of rights and privileges.

Class A shares, for example, give shareholders voting rights, while Class C shares do not. This might sound like a minor detail, but it can have a big impact on how the company is governed. So, when you're thinking about investing in Google stock, it's important to understand what you're getting into. Trust me, it makes a difference.

Why Should You Care About Google Stock?

Here's the deal: Google stock is more than just a financial instrument. It's a reflection of the company's overall health and performance. When Google does well, its stock tends to perform well too. And let's be honest, Google has been doing pretty darn well. From its dominant position in online advertising to its expanding presence in cloud computing, there's a lot to like about this company.

But here's the thing—investing in Google stock isn't without its risks. The tech industry is constantly evolving, and companies like Google face stiff competition from other tech giants. So, while the potential rewards are huge, you need to be prepared for some ups and downs along the way. That's why it's crucial to do your research and understand the factors that can impact Google stock.

Understanding the Financial Performance of Google Stock

Let's talk numbers, baby! Google stock has delivered some impressive returns over the years. Since its initial public offering (IPO) in 2004, the stock has grown significantly, making early investors very happy. But what drives this growth? Well, it's a combination of factors, including Google's dominant position in online advertising, its expanding cloud business, and its investments in innovative technologies like AI and self-driving cars.

Take a look at these stats: In 2022 alone, Alphabet reported revenues of over $283 billion, with net income of $59.9 billion. That's some serious cash, my friend! And while the stock price has experienced some volatility, the overall trend has been upward. Of course, past performance is no guarantee of future results, but these numbers give you a sense of just how powerful Google's business model is.

Read also:Allentown Tire Your Ultimate Guide To Reliable Tire Solutions

Key Drivers of Google Stock Performance

So, what exactly drives the performance of Google stock? Here are a few key factors:

- Advertising Revenue: Google's search engine and YouTube platform generate the majority of its revenue through advertising. As long as people keep searching and watching, this revenue stream is likely to remain strong.

- Cloud Computing: Google Cloud is growing rapidly and becoming an increasingly important part of the company's revenue mix. This division is investing heavily in infrastructure and technology to compete with Amazon Web Services and Microsoft Azure.

- Innovation: Google is constantly pushing the boundaries of what's possible. From AI-powered search to autonomous vehicles, the company is always looking for the next big thing. This focus on innovation helps drive long-term growth.

These factors, among others, play a crucial role in determining the performance of Google stock. And as the tech landscape continues to evolve, it's likely that new opportunities will emerge for the company to grow and expand.

How to Analyze Google Stock

Alright, let's talk about how to analyze Google stock. Whether you're a beginner or a seasoned investor, understanding the basics of stock analysis is essential. There are two main approaches to analyzing stocks: fundamental analysis and technical analysis. Let's break them down.

Fundamental analysis involves looking at the company's financial health, including its revenue, earnings, and growth prospects. It also involves evaluating the competitive landscape and the overall industry trends. For Google, this means looking at its advertising revenue, cloud computing growth, and innovation pipeline.

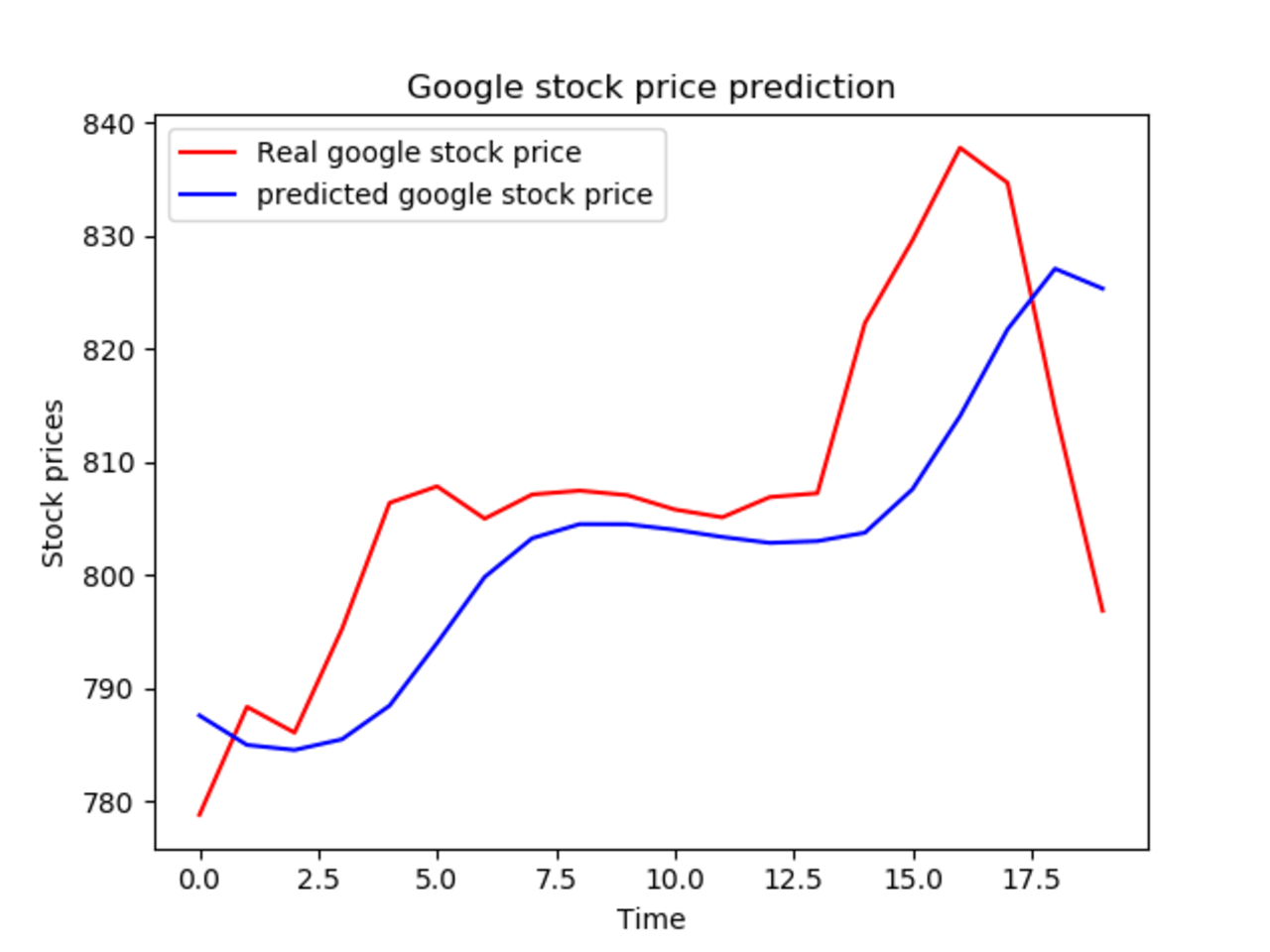

Technical analysis, on the other hand, focuses on historical price movements and trading patterns. By studying charts and using various indicators, technical analysts try to predict future price movements. While this approach can be useful, it's important to remember that it doesn't take into account the underlying fundamentals of the company.

Key Metrics to Watch for Google Stock

When analyzing Google stock, there are a few key metrics you should keep an eye on:

- P/E Ratio: This measures how much investors are willing to pay for each dollar of earnings. A high P/E ratio can indicate that investors have high expectations for future growth.

- Revenue Growth: This shows how much the company's revenue is increasing year over year. For a company like Google, strong revenue growth is a good sign.

- Free Cash Flow: This measures how much cash the company generates after accounting for capital expenditures. A healthy free cash flow indicates that the company has the resources to invest in new opportunities.

By tracking these metrics, you can get a better sense of how Google stock is performing and whether it's a good investment opportunity.

Historical Performance of Google Stock

Now, let's take a look at the historical performance of Google stock. Since its IPO in 2004, the stock has seen some incredible growth. In fact, if you had invested $1,000 in Google stock back then, your investment would be worth well over $10,000 today. That's some serious return on investment!

But it hasn't all been smooth sailing. Google stock has experienced its fair share of ups and downs over the years. For example, during the 2008 financial crisis, the stock price took a hit, along with the rest of the market. However, it quickly rebounded and continued its upward trajectory.

Key Events That Impacted Google Stock

Here are a few key events that have had a significant impact on Google stock:

- IPO in 2004: Google's initial public offering marked the beginning of its journey as a publicly traded company. It was a big moment for the company and its investors.

- Reorganization into Alphabet in 2015: This move was designed to streamline the company's operations and give investors a clearer picture of its financial performance. It also created a new class of stock, Class C shares.

- Pandemic in 2020: Like many companies, Google was initially hit hard by the pandemic, as advertising spending dropped. However, it quickly rebounded as digital advertising became more important than ever.

These events, among others, have shaped the performance of Google stock over the years. And as the company continues to evolve, it's likely that new events will emerge that could impact its stock price.

Risks Associated with Google Stock

Let's be real for a sec—investing in Google stock isn't without its risks. While the company has a strong track record of growth and innovation, there are several factors that could impact its performance in the future. Here are a few key risks to keep in mind:

- Regulatory Challenges: As a dominant player in the tech industry, Google faces increasing scrutiny from regulators around the world. Antitrust investigations and potential fines could impact its bottom line.

- Competition: The tech industry is highly competitive, and companies like Amazon, Microsoft, and Facebook are all vying for market share. Google needs to stay ahead of the curve to maintain its competitive edge.

- Economic Downturns: Economic slowdowns can impact advertising spending, which is a key driver of Google's revenue. While the company has weathered previous downturns, there's no guarantee it will do so in the future.

While these risks shouldn't deter you from investing in Google stock, it's important to be aware of them and factor them into your decision-making process.

Future Prospects for Google Stock

Looking ahead, the future looks bright for Google stock. The company is well-positioned to continue its growth trajectory, thanks to its dominant position in online advertising, expanding cloud business, and focus on innovation. But what does the future hold for Google stock specifically?

Here are a few key trends to watch:

- AI and Machine Learning: Google is investing heavily in AI and machine learning, and these technologies are likely to play an increasingly important role in its products and services.

- Cloud Computing: As more businesses move to the cloud, Google Cloud is poised to capture a larger share of the market. This division is growing rapidly and could become a major revenue driver in the coming years.

- International Expansion: Google is expanding its presence in emerging markets, where there's significant growth potential. This could help drive revenue growth in the future.

While there are certainly challenges ahead, the future looks promising for Google stock. And as the company continues to innovate and grow, it's likely that its stock will continue to perform well.

How to Invest in Google Stock

Alright, so you're convinced that Google stock is worth considering. But how do you actually go about investing in it? Here's a quick guide:

- Choose a Broker: The first step is to choose a reputable online broker. There are plenty of options out there, so do your research and choose one that suits your needs.

- Open an Account: Once you've chosen a broker, open an account and fund it with the amount you want to invest.

- Place Your Order: When you're ready, place an order for Google stock. You can choose between buying Class A or Class C shares, depending on your preference.

Remember, investing in stocks involves risk, so make sure you're comfortable with the potential ups and downs before diving in.

Final Thoughts

Well, there you have it—a comprehensive guide to understanding Google stock. From its impressive financial performance to its future prospects, there's a lot to like about this company. But remember, investing in stocks isn't just about chasing returns; it's about doing your research and making informed decisions.

So, what's next? If you're interested in learning more, be sure to check out our other articles on the stock market and investing. And don't forget to leave a comment or share this article with your friends. Together, we can all become smarter, savvier investors!

Table of Contents

Google Stock: The Ultimate Guide to Understanding Its Growth, Trends, and Potential

Why Should You Care About Google Stock?

Understanding the Financial Performance of Google Stock

Key Drivers of Google Stock Performance

Key Metrics to Watch for Google Stock

Historical Performance of Google Stock

Key Events That Impacted Google Stock