Ever wondered if Intel stock is the golden ticket you've been searching for in the stock market? Let's dive right into it. If you're reading this, chances are you're either already knee-deep in the world of stocks or just dipping your toes into the financial ocean. Intel stock has been around the block, and it's time to break down what makes it tick. Whether you're a newbie or a seasoned investor, this guide will help you make sense of Intel's stock performance, trends, and potential.

Intel stock has been a staple in the tech sector for decades, but let's not sugarcoat it. The world of tech is as unpredictable as a rollercoaster, and Intel hasn't been immune to the ups and downs. With advancements in AI, cloud computing, and semiconductor tech, Intel's stock is at a crossroads. Is it still a smart investment? Or is it time to pivot?

Here's the deal: this article isn't just another boring stock market spiel. We're breaking it down in a way that's relatable, actionable, and most importantly, easy to digest. So, buckle up because we're about to explore the ins and outs of Intel stock, from its history to its future prospects. Stick around because there's a lot to unpack.

Read also:Colts Fb The Unsung Heroes Of The Gridiron

Table of Contents

- Introduction

- Intel's Biography

- A Look Back: Intel Stock History

- Intel Stock Market Performance

- Key Drivers of Intel Stock

- Risks and Challenges

- Future Prospects for Intel Stock

- Building an Investment Strategy

- Data and Statistics to Know

- Conclusion

Intel's Biography

Before we dive into the stock itself, let's take a moment to meet the brains behind the operation. Intel Corporation was founded way back in 1968 by Gordon Moore and Robert Noyce, two legends in the tech world. If you're familiar with Moore's Law, you already know Gordon Moore's genius. Intel started as a memory chip manufacturer but quickly pivoted to microprocessors, becoming a household name in the process.

Here's a quick snapshot of Intel's journey:

| Founder | Gordon Moore, Robert Noyce |

|---|---|

| Year Founded | 1968 |

| Headquarters | Santa Clara, California |

| Revenue (2022) | $74.1 billion |

| Employees | 117,000+ |

A Look Back: Intel Stock History

Intel stock has had its fair share of highs and lows over the years. Back in the dot-com boom of the late '90s, Intel was on fire, and its stock price reflected that. But like many tech giants, it took a hit during the dot-com bust. Fast forward to today, and Intel stock is still a hot topic among investors, even as competition heats up in the semiconductor space.

One of the most notable moments in Intel's stock history was the introduction of the Pentium processor. This little chip revolutionized personal computing, and Intel's stock soared as a result. But let's not forget the not-so-great moments, like the infamous "Pentium FDIV bug" scandal, which cost Intel a pretty penny.

Intel Stock Market Performance

Now, let's talk about what you really came here for—Intel's stock performance. Over the past decade, Intel stock has seen some impressive gains, but it hasn't been a straight upward trajectory. The stock has faced headwinds from increasing competition and supply chain disruptions, but it's still a player to watch.

In 2022, Intel's stock price hovered around $30-$50 per share, a far cry from its all-time high of over $70 per share in 2000. But don't let the numbers fool you. Intel's stock is still a favorite among dividend investors, offering a solid yield that's hard to ignore.

Read also:Celebrity In Dti Where Fame Meets Entrepreneurship

Key Drivers of Intel Stock

So, what's driving Intel's stock performance? There are a few key factors to consider:

- Innovation: Intel's ability to innovate is a big deal. From AI to 5G, the company is investing heavily in cutting-edge tech.

- Global Demand: As the world becomes more connected, the demand for semiconductors is skyrocketing. Intel is right in the thick of it.

- Cost Management: Intel's focus on reducing costs and improving efficiency is crucial for maintaining profitability.

Risks and Challenges

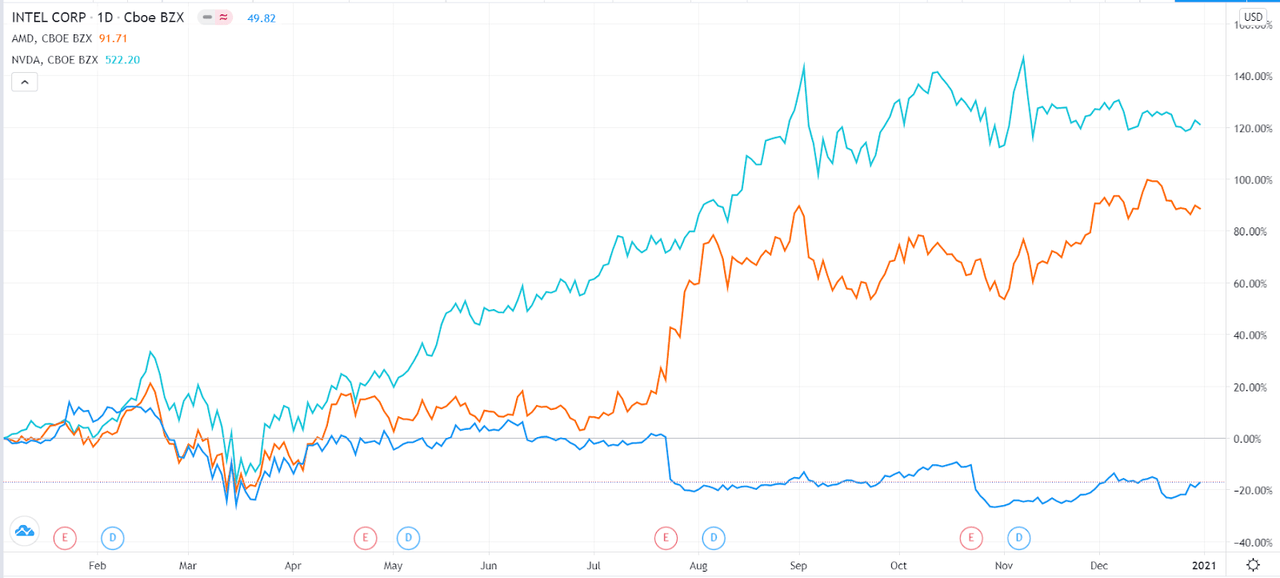

No investment is without risks, and Intel stock is no exception. One of the biggest challenges Intel faces is stiff competition from companies like AMD and NVIDIA. These players are nipping at Intel's heels, and the battle for market share is fierce.

Supply chain issues have also been a thorn in Intel's side. The global semiconductor shortage has affected everyone, and Intel hasn't been immune. Add to that geopolitical tensions and trade restrictions, and you've got a recipe for volatility.

Future Prospects for Intel Stock

Despite the challenges, the future looks bright for Intel stock. The company is making bold moves to stay ahead of the curve. One of its biggest initiatives is the IDM 2.0 strategy, which aims to revamp its manufacturing capabilities and compete with foundry giants like TSMC.

Intel is also doubling down on AI and data-centric technologies. With the rise of cloud computing and edge computing, the demand for Intel's products is only going to grow. If Intel can execute its plans successfully, the stock could see some serious upside.

Building an Investment Strategy

Now, let's talk strategy. If you're thinking about adding Intel stock to your portfolio, here are a few tips to keep in mind:

- Do Your Research: Understand Intel's business model, competitors, and market trends.

- Consider Your Goals: Are you looking for capital appreciation or income? Intel's stock offers both.

- Stay Informed: Keep an eye on industry news and Intel's earnings reports.

Remember, investing is a marathon, not a sprint. Don't let short-term market fluctuations sway your long-term strategy.

Data and Statistics to Know

Let's crunch some numbers. Here are a few stats to keep in your back pocket:

- Intel's market cap is approximately $115 billion (as of 2023).

- The company's dividend yield is around 4%, making it a favorite among income investors.

- Intel's revenue has been relatively stable over the past few years, hovering around $70 billion annually.

These numbers give you a snapshot of Intel's financial health, but always dig deeper before making investment decisions.

Conclusion

Investing in Intel stock isn't for the faint of heart, but it can be a rewarding experience if you play your cards right. The company has a rich history, a solid product lineup, and a promising future. However, it's not without its challenges, and staying informed is key to success.

So, what's next? If you've found this article helpful, drop a comment or share it with your friends. And if you're ready to dive deeper into the world of stocks, check out our other articles for more insights and tips. Remember, the stock market is a journey, and every step counts.

Oh, and one last thing—don't forget to do your homework. The more you know, the better you'll be at navigating the ups and downs of Intel stock and the stock market in general. Happy investing, and may the odds be ever in your favor!