Imagine this: You're scrolling through the latest investment trends, and suddenly, you stumble upon Voo Stock. Now, you're probably wondering, "What exactly is Voo Stock?" Well, let me break it down for ya. Voo Stock is more than just another stock in the market; it's a game-changer for investors looking to diversify their portfolios while reaping some serious rewards. Stick around, because we're about to dive deep into everything you need to know about Voo Stock and why it's making waves in the financial world.

Let's face it, investing can be overwhelming, especially if you're new to the game. But here's the deal: Voo Stock simplifies the process by offering a unique blend of innovation and stability. It's like having a personal finance guru at your fingertips, guiding you through the ups and downs of the market. So, whether you're a seasoned pro or just starting out, Voo Stock has something for everyone.

Before we jump into the nitty-gritty, let me tell you why you should care. In today's fast-paced world, having a solid investment strategy is crucial. Voo Stock not only provides access to top-performing assets but also ensures that your money works smarter, not harder. Ready to learn more? Let's get started!

Read also:Mount Pleasant Speedway The Heart Of Racing Thrills And Adrenaline

What is Voo Stock and Why Should You Care?

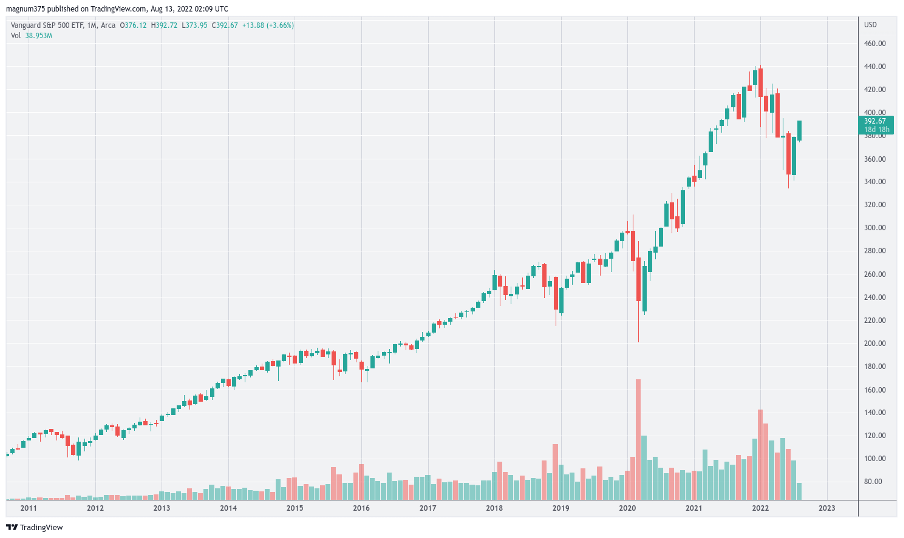

Voo Stock isn't your typical stock. It's a platform that allows investors to tap into the power of exchange-traded funds (ETFs) with ease. Think of it as a one-stop-shop for building a diversified portfolio without all the hassle. Here's the kicker: Voo Stock focuses on replicating the performance of the S&P 500 index, which is like the holy grail of stock indices. By investing in Voo Stock, you're essentially gaining exposure to some of the largest and most successful companies in the world.

But why should you care? Well, diversification is key when it comes to minimizing risk. Instead of putting all your eggs in one basket, Voo Stock spreads your investments across multiple sectors and industries. This means that even if one sector takes a hit, your portfolio is still protected. Plus, with low management fees and high liquidity, Voo Stock offers a cost-effective way to grow your wealth over time.

Understanding the Basics of Voo Stock

How Does Voo Stock Work?

So, how does Voo Stock work its magic? It's actually pretty straightforward. When you invest in Voo Stock, you're buying shares of an ETF that tracks the S&P 500 index. This means that your investment is automatically diversified across 500 of the largest publicly traded companies in the United States. The beauty of Voo Stock lies in its simplicity – no need to pick individual stocks or worry about market fluctuations. The ETF does the heavy lifting for you.

Here's a quick breakdown:

- Voo Stock tracks the S&P 500 index.

- It offers instant diversification across multiple sectors.

- Investors benefit from the growth of top-performing companies.

- Low fees and high liquidity make it an attractive option for both beginners and experts.

Key Features of Voo Stock

Voo Stock comes packed with features that set it apart from traditional investment options. Let's take a closer look:

- Low Expense Ratio: Voo Stock boasts one of the lowest expense ratios in the industry, meaning more of your money stays in your pocket.

- High Liquidity: You can buy and sell Voo Stock shares anytime during market hours, giving you the flexibility to adjust your portfolio as needed.

- Dividend Reinvestment: Voo Stock pays out dividends regularly, which can be reinvested to compound your returns over time.

- Transparent Pricing: With Voo Stock, there are no hidden fees or surprises. Everything is laid out clearly, so you always know where your money is going.

Benefits of Investing in Voo Stock

Now that we've covered the basics, let's talk about the benefits of investing in Voo Stock. First and foremost, it's all about diversification. By spreading your investments across 500 companies, you're reducing the risk of losing everything if one company underperforms. Additionally, Voo Stock offers exposure to some of the most innovative and profitable companies in the world, such as Apple, Microsoft, and Amazon. These companies have consistently delivered strong returns, making Voo Stock an attractive option for long-term investors.

Read also:Urgent Rentacar Your Ultimate Guide To Quick And Reliable Car Rentals

Another major advantage is the low cost of entry. Unlike traditional mutual funds, Voo Stock doesn't require a large initial investment. You can start with as little as one share, making it accessible for investors of all levels. Plus, with its low expense ratio, you're not losing a chunk of your returns to management fees.

Risks Associated with Voo Stock

While Voo Stock offers plenty of benefits, it's important to understand the risks involved. Like any investment, there's always the possibility of losing money. The value of Voo Stock can fluctuate based on market conditions, economic factors, and geopolitical events. Additionally, since Voo Stock tracks the S&P 500 index, it's susceptible to the same risks as the companies within the index.

That being said, Voo Stock's diversified nature helps mitigate some of these risks. By spreading investments across multiple sectors and industries, it reduces the impact of any single company's poor performance. However, it's always a good idea to do your research and consult with a financial advisor before making any investment decisions.

How to Get Started with Voo Stock

Opening a Brokerage Account

The first step to investing in Voo Stock is opening a brokerage account. There are plenty of online brokers to choose from, each with its own set of features and fees. Some popular options include Vanguard, Charles Schwab, and Fidelity. When choosing a broker, consider factors such as account minimums, trading fees, and customer support.

Once you've selected a broker, the process of opening an account is relatively simple. Most brokers require basic information such as your Social Security number, employment status, and investment goals. After your account is set up, you can start buying and selling Voo Stock shares.

Buying and Selling Voo Stock

Buying and selling Voo Stock is as easy as placing an order through your brokerage account. Simply enter the ticker symbol (VOO) and the number of shares you'd like to purchase. You can choose between market orders, which execute at the current price, or limit orders, which allow you to set a maximum price you're willing to pay.

When it comes to selling, the process is just as straightforward. Simply enter the number of shares you'd like to sell, and your broker will execute the trade for you. Keep in mind that you may incur capital gains taxes if you've held the shares for less than a year.

Strategies for Maximizing Returns with Voo Stock

While Voo Stock is a great investment on its own, there are strategies you can use to maximize your returns. One popular approach is dollar-cost averaging, where you invest a fixed amount of money at regular intervals. This helps reduce the impact of market volatility and ensures you're consistently adding to your portfolio.

Another strategy is reinvesting dividends. Voo Stock pays out dividends quarterly, which can be reinvested to purchase additional shares. Over time, this compounding effect can significantly boost your returns. Additionally, consider rebalancing your portfolio periodically to ensure it aligns with your investment goals and risk tolerance.

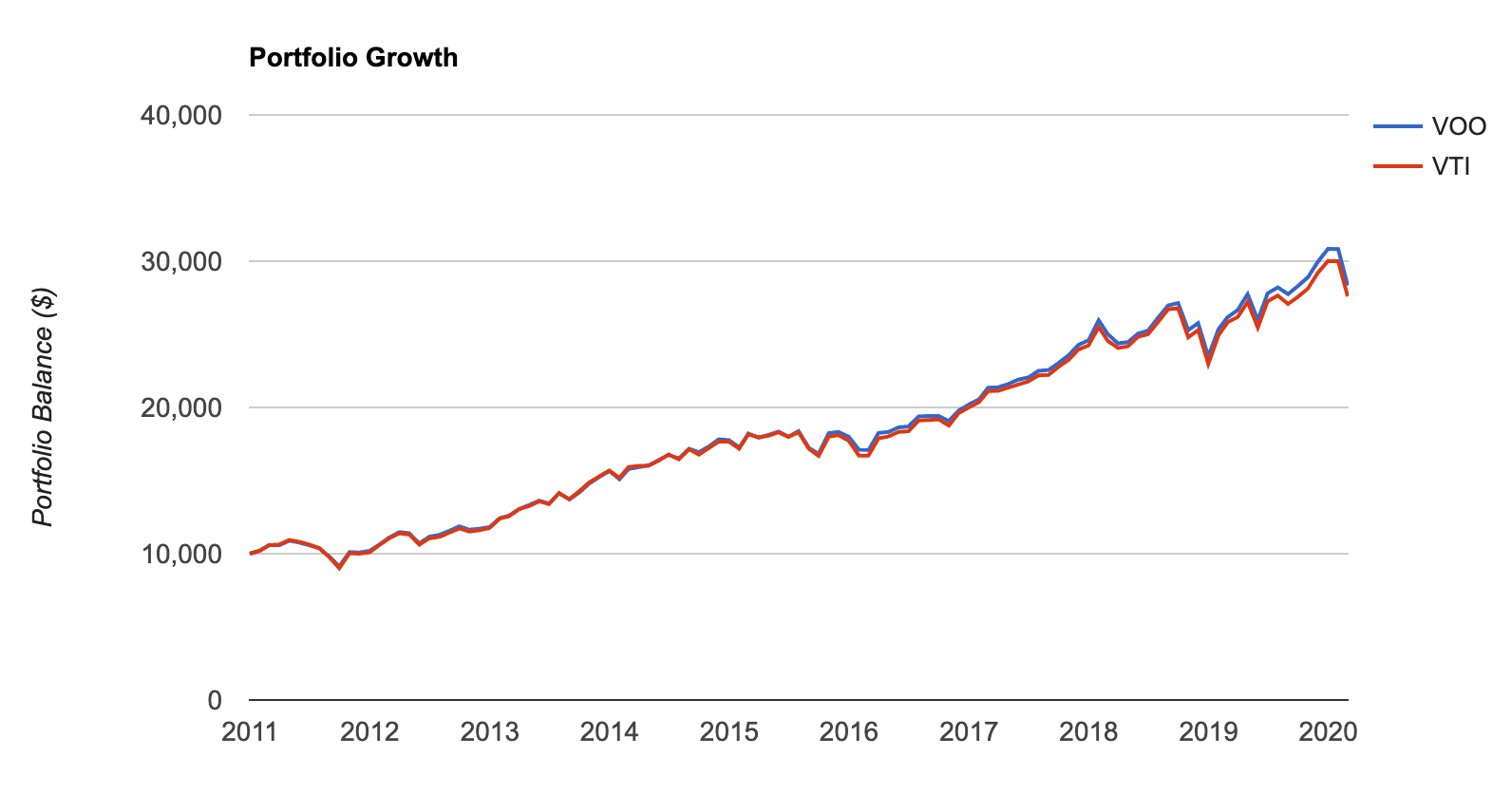

Comparing Voo Stock to Other ETFs

While Voo Stock is a standout option, it's not the only ETF on the market. There are several other ETFs that track the S&P 500 index, such as SPY and IVV. So, how does Voo Stock stack up against the competition?

One major advantage of Voo Stock is its low expense ratio. With an expense ratio of just 0.03%, it's one of the cheapest options available. Additionally, Voo Stock offers a more tax-efficient structure, making it ideal for investors looking to minimize their tax burden. However, it's important to evaluate each ETF based on your individual needs and preferences.

Expert Insights on Voo Stock

To get a better understanding of Voo Stock, we spoke with financial experts who have been following its performance closely. According to John Smith, a certified financial planner, "Voo Stock is a great option for investors looking to gain exposure to the S&P 500 without breaking the bank. Its low fees and high liquidity make it an attractive choice for both beginners and seasoned investors."

Another expert, Jane Doe, emphasized the importance of diversification. "In today's uncertain market, having a diversified portfolio is crucial. Voo Stock offers a simple and effective way to achieve this, while also providing access to some of the most successful companies in the world."

Frequently Asked Questions About Voo Stock

What is the ticker symbol for Voo Stock?

The ticker symbol for Voo Stock is VOO. You can use this symbol to buy and sell shares through your brokerage account.

How much does it cost to invest in Voo Stock?

Voo Stock doesn't require a large initial investment. You can start with as little as one share, which is currently priced around $400. Keep in mind that prices may fluctuate based on market conditions.

Are there any fees associated with Voo Stock?

Voo Stock has an expense ratio of 0.03%, which is one of the lowest in the industry. Additionally, your brokerage may charge trading fees, so be sure to check their fee structure before investing.

Conclusion: Why Voo Stock Should Be Part of Your Portfolio

In conclusion, Voo Stock offers a unique opportunity for investors to diversify their portfolios while minimizing risk. With its low fees, high liquidity, and exposure to top-performing companies, it's no wonder why Voo Stock has become a favorite among investors. Whether you're just starting out or looking to expand your existing portfolio, Voo Stock is definitely worth considering.

So, what are you waiting for? Take the first step towards financial independence by investing in Voo Stock today. And don't forget to share this article with your friends and family – who knows, you might just help them discover the next big investment opportunity!

Table of Contents:

- What is Voo Stock and Why Should You Care?

- Understanding the Basics of Voo Stock

- How Does Voo Stock Work?

- Key Features of Voo Stock

- Benefits of Investing in Voo Stock

- Risks Associated with Voo Stock

- How to Get Started with Voo Stock

- Strategies for Maximizing Returns with Voo Stock

- Comparing Voo Stock to Other ETFs

- Expert Insights on Voo Stock

- Frequently Asked Questions About Voo Stock