Hey there, investor friend! Let’s dive straight into the world of TQQQ stock, because let’s be honest—it’s like a wild rollercoaster that keeps everyone on their toes. Whether you’re a seasoned trader or just starting out, TQQQ has been making waves in the market, and for good reason. This triple-leveraged ETF tracking the Nasdaq-100 index is not for the faint of heart, but it sure can be rewarding—if you play your cards right. So buckle up, because we’re about to break it all down for you!

TQQQ stock is more than just another ticker symbol on your trading platform. It’s a financial instrument that amplifies the returns (and risks) of the tech-heavy Nasdaq-100. For those who are unfamiliar, this ETF is designed to deliver 3x the daily performance of the index, which means it’s a high-stakes game. While some investors love the thrill of potentially huge gains, others are cautious about the volatility it brings to the table.

Now, before we go any further, let’s get one thing straight: TQQQ isn’t for everyone. If you’re the type who prefers steady, long-term growth, this might not be the right fit for your portfolio. But if you’re looking for excitement and are willing to take on some risk, TQQQ could be your next big adventure. Let’s explore why this stock has been grabbing headlines and what it means for your investment strategy.

Read also:Yeraldin Vasan The Rising Star Whos Making Waves In The Entertainment World

Table of Contents:

- What is TQQQ Stock?

- Basics of TQQQ ETF

- Why is TQQQ So Volatile?

- TQQQ Stock Performance

- Risks of Investing in TQQQ

- Trading Strategies for TQQQ

- TQQQ vs SQQQ: What’s the Difference?

- Is TQQQ a Good Investment?

- Outlook for TQQQ in 2023

- Final Thoughts on TQQQ Stock

What is TQQQ Stock?

Alright, let’s start with the basics. TQQQ, or ProShares UltraPro QQQ, is an exchange-traded fund (ETF) that offers 3x leverage on the daily performance of the Nasdaq-100 Index. This means if the Nasdaq-100 goes up by 1%, TQQQ aims to deliver a 3% gain. Conversely, if the index drops by 1%, TQQQ could fall by 3%. Sounds simple enough, right? But here’s the catch: this 3x leverage is reset daily, which can lead to some pretty wild swings over time.

For traders who are chasing big returns, TQQQ is like the ultimate adrenaline rush. However, it’s important to note that the ETF’s performance can deviate significantly from the index over longer periods due to something called "compounding effects." This is why TQQQ is often considered a short-term trading vehicle rather than a long-term investment.

Basics of TQQQ ETF

Understanding Leveraged ETFs

Before we get too deep into TQQQ, let’s talk about leveraged ETFs in general. These funds use financial derivatives to amplify the returns of an underlying index. While they can offer huge upside potential, they also come with increased risk. TQQQ specifically targets the Nasdaq-100, which is dominated by tech giants like Apple, Microsoft, and Amazon. This gives it a unique edge in the market, but also ties its fate closely to the performance of the tech sector.

Here’s a quick rundown of what makes TQQQ stand out:

- 3x Leverage: Amplifies daily returns (or losses) of the Nasdaq-100.

- Reset Daily: The leverage is reset every day, which can lead to significant deviations over time.

- High Volatility: Expect big swings in both directions.

- Short-Term Focus: Best suited for traders looking to capitalize on short-term market moves.

Why is TQQQ So Volatile?

Let’s face it—TQQQ is not for the weak-hearted. The reason it’s so volatile boils down to two main factors: leverage and the nature of the Nasdaq-100. The 3x leverage means that even small movements in the underlying index can result in massive swings in TQQQ’s price. Add to that the fact that the Nasdaq-100 itself is heavily influenced by tech stocks, which are known for their volatility, and you’ve got a recipe for some serious market action.

Read also:Nspa Nails The Ultimate Guide To Transforming Your Nail Game

Another thing to keep in mind is the compounding effect we mentioned earlier. Over time, the daily resets can cause the ETF’s performance to diverge significantly from the index it tracks. This is why TQQQ is often used as a trading tool rather than a buy-and-hold investment. For those who are willing to ride the waves, though, the potential rewards can be substantial.

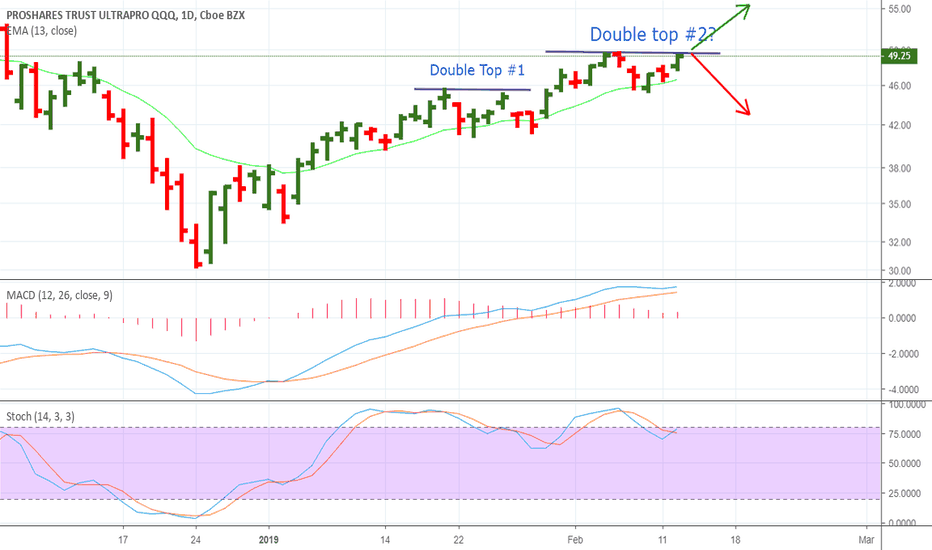

TQQQ Stock Performance

Historical Performance

Over the years, TQQQ has delivered some jaw-dropping returns during bull markets. For example, in 2020, when the tech sector was on fire, TQQQ saw its value skyrocket. However, during downturns, the ETF has also experienced steep declines. This is the double-edged sword of leverage—big gains come with the risk of big losses.

Let’s look at some key stats:

- Best Year: In 2020, TQQQ gained over 300%, riding the tech boom.

- Worst Year: During the 2008 financial crisis, TQQQ lost over 90% of its value.

- Recent Performance: As of 2023, TQQQ has been bouncing back from the 2022 bear market, but it’s still a rollercoaster ride.

Risks of Investing in TQQQ

Now, let’s talk about the risks. TQQQ isn’t just volatile—it’s also complex. Here are some key risks to consider:

- Leverage Risk: The 3x leverage can amplify losses just as much as gains.

- Compounding Effects: Over time, the daily resets can cause the ETF’s performance to deviate from the index.

- Market Risk: TQQQ is heavily tied to the tech sector, which can be unpredictable.

- Liquidity Risk: While TQQQ is generally liquid, extreme market conditions can affect its trading volume.

It’s crucial to understand these risks before jumping into TQQQ. If you’re not comfortable with the potential downsides, it might be worth considering other investment options.

Trading Strategies for TQQQ

Day Trading TQQQ

Many traders use TQQQ as a day-trading instrument. The key here is to capitalize on short-term market movements while managing risk. Some popular strategies include:

- Momentum Trading: Buying when the market is trending up and selling when it reverses.

- Scalping: Making small, frequent trades to capture minor price movements.

- Swing Trading: Holding positions for a few days to weeks, aiming to profit from larger price swings.

Remember, day trading TQQQ requires discipline and a solid risk management plan. It’s not for everyone, but for those who can handle the pressure, it can be rewarding.

TQQQ vs SQQQ: What’s the Difference?

While TQQQ offers 3x leverage to the upside, its counterpart, SQQQ, provides 3x leverage to the downside. This means if the Nasdaq-100 falls by 1%, SQQQ aims to gain 3%. Both ETFs are popular among traders, but they serve different purposes. TQQQ is typically used during bull markets, while SQQQ is favored during bear markets or as a hedge against market declines.

Choosing between TQQQ and SQQQ depends on your market outlook and risk tolerance. If you’re bullish on tech, TQQQ might be the way to go. But if you’re expecting a downturn, SQQQ could be a safer bet.

Is TQQQ a Good Investment?

Whether TQQQ is a good investment depends on your goals and risk appetite. For short-term traders looking to capitalize on market movements, it can be an excellent tool. However, for long-term investors seeking stable growth, it might not be the best choice. TQQQ’s volatility and daily resets make it unsuitable for buy-and-hold strategies.

Before investing in TQQQ, ask yourself these questions:

- Am I comfortable with the risks involved?

- Do I have a solid trading plan?

- Can I handle the ups and downs of a volatile asset?

If you answered yes to all of these, TQQQ might be worth exploring. But if you’re unsure, it’s always a good idea to consult with a financial advisor.

Outlook for TQQQ in 2023

As we move deeper into 2023, the outlook for TQQQ remains uncertain. The tech sector, which drives the Nasdaq-100, has been recovering from the 2022 bear market, but geopolitical tensions and economic uncertainty could still impact performance. That said, with interest in tech stocks on the rise, TQQQ could see some exciting opportunities ahead.

Traders who are able to navigate the market’s twists and turns may find success with TQQQ. However, it’s important to stay informed and adapt to changing conditions. Keep an eye on economic indicators, tech earnings reports, and broader market trends to make informed decisions.

Final Thoughts on TQQQ Stock

TQQQ stock is undoubtedly one of the most exciting financial instruments out there. Its 3x leverage and close tie to the Nasdaq-100 make it a powerful tool for traders looking to capitalize on short-term market moves. However, it’s not without its risks. The volatility and complexity of TQQQ mean that it’s not suitable for everyone.

If you’re considering adding TQQQ to your portfolio, make sure you understand the risks and have a solid trading plan in place. And remember, while the potential rewards can be huge, so can the losses. As always, do your research and consider consulting with a financial advisor before making any investment decisions.

So, what do you think? Is TQQQ the right choice for you? Let us know in the comments below, and don’t forget to share this article with your fellow investors. Happy trading, and may the market be in your favor!